Signal Climate Analytics Team

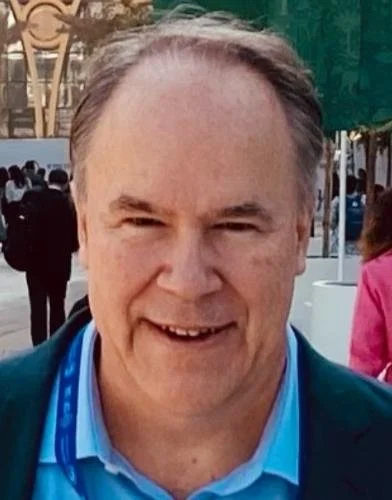

Tim Nixon

Co-Founder & Managing Director

Tim Nixon is Co-Founder and Managing Director of Signal Climate Analytics. He is an ongoing research contributor to Reuters News and serves on the judging panel for the Reuters Sustainable Business Awards. He is the Founder and served as Managing Editor of the Sustainability thought-leadership platform at Thomson Reuters. He is a Founder and Knowledge Partner to the United Nations Science, Business & Policy Forum, and is a member of the United Nations Expert Group, Data for the Environment Alliance (DEAL). He led a multi-year initiative of research collaboration with the Calvert Center for Responsible Investing. Tim is an innovator for positive change by nature and has a decades-long record of building impactful products and initiatives across legal and financial services businesses.

Andrea Schmitz

Co-Founder

Andrea is a former VP of Environment Health & Safety at Con Edison. She held numerous positions during her 25-year tenure, including Environmental Manager for Gas Operations. Andrea worked at the U.S. EPA as Natural Gas STAR Program Manager and as EPA representative to the US/Gazprom methane working group. She was Adjunct Professor at Columbia University’s MPA Program in Environmental Science and Policy.

Dominic Emery

Partner

Dominic is a senior energy advisor, with experience at British Petroleumas Chief of Staff and Head of Strategy. He was also Founding CEO of the $1 billion Oil & Gas Climate Initiative (OGCI) Climate Investment fund, backed by 12 of the world’s largest oil and gas companies.

Robert Jenkins

Partner

Robert is the Head of AI Agentic Solutions for the Finance industry vertical with AinsteinAI. Global head of Research & Lipper-London Stock Exchange Group. Institutional portfolio Manager and Retail trading Executive at Fidelity Investments. Consultant with McKinsey and AlixPartners. Investment Advisory Council at Betterment.

Robin Castelli

Partner

Robin Castelli is Head of Transition Finance Investment at Orange Ridge Capital and is the Author of “Quantitative Methods for ESGFinance” by Wiley (2022). He led the Climate Transition Risk Model Development team at Citi in 2023-2024, covering over $730 Billion in WCR and CRE exposures. He was also the Chief Strategy Officer for Quantitative Risk and Stress Testing at Citi and is a frequent lecturer on Climate and Transition finance at prestigious universities and conferences around the world such as Columbia, Bocconi, and the Stevens Institute of Technology.